Trust Foundations: Making Sure Sturdiness and Dependability

Trust Foundations: Making Sure Sturdiness and Dependability

Blog Article

Protecting Your Properties: Depend On Foundation Proficiency within your reaches

In today's complex economic landscape, making sure the safety and security and development of your possessions is critical. Depend on structures offer as a foundation for securing your riches and legacy, offering an organized strategy to asset security. Knowledge in this world can offer invaluable support on browsing lawful complexities, taking full advantage of tax obligation efficiencies, and producing a robust financial plan customized to your unique demands. By taking advantage of this specialized understanding, people can not just safeguard their assets efficiently yet likewise lay a solid foundation for lasting wide range conservation. As we explore the details of trust fund foundation expertise, a globe of possibilities unravels for strengthening your monetary future.

Importance of Depend On Foundations

Count on structures play a vital role in developing integrity and cultivating solid partnerships in various professional settings. Depend on structures offer as the foundation for moral decision-making and transparent communication within organizations.

Advantages of Expert Assistance

Building on the foundation of count on expert partnerships, looking for professional support offers invaluable advantages for individuals and companies alike. Expert support gives a wealth of expertise and experience that can assist navigate intricate economic, lawful, or tactical difficulties easily. By leveraging the knowledge of professionals in different fields, individuals and organizations can make informed decisions that straighten with their objectives and goals.

One substantial advantage of specialist advice is the ability to access specialized expertise that may not be readily available otherwise. Professionals can provide understandings and point of views that can bring about cutting-edge solutions and opportunities for development. In addition, collaborating with experts can help minimize threats and unpredictabilities by giving a clear roadmap for success.

In addition, professional guidance can save time and sources by simplifying procedures and preventing costly mistakes. trust foundations. Experts can supply individualized guidance tailored to certain requirements, ensuring that every decision is well-informed and tactical. On the whole, the advantages of professional guidance are multifaceted, making it a useful asset in guarding and making best use of properties for the lengthy term

Ensuring Financial Security

Ensuring economic safety and security involves a multifaceted approach that encompasses different elements of wealth monitoring. By spreading financial investments across various asset classes, such as stocks, bonds, real estate, and products, the threat of substantial economic loss can be alleviated.

Additionally, maintaining an emergency fund is important to secure against unanticipated sites costs or revenue interruptions. Professionals advise alloting 3 to six months' worth of living costs in a liquid, conveniently obtainable account. This fund acts as a financial safeguard, offering tranquility of mind during turbulent times.

Routinely assessing and adjusting financial strategies in feedback to changing scenarios is additionally critical. Life events, market changes, and legislative modifications can affect economic stability, highlighting the relevance of continuous examination and adjustment in the search of long-lasting monetary safety - trust foundations. By implementing these techniques attentively and constantly, people can fortify their monetary ground and job in the direction of a more secure future

Protecting Your Possessions Properly

With a strong structure in place for financial safety and security via diversity and emergency situation fund upkeep, the next important action is protecting your possessions properly. One effective strategy is property allocation, which includes spreading your investments across different property courses to minimize risk.

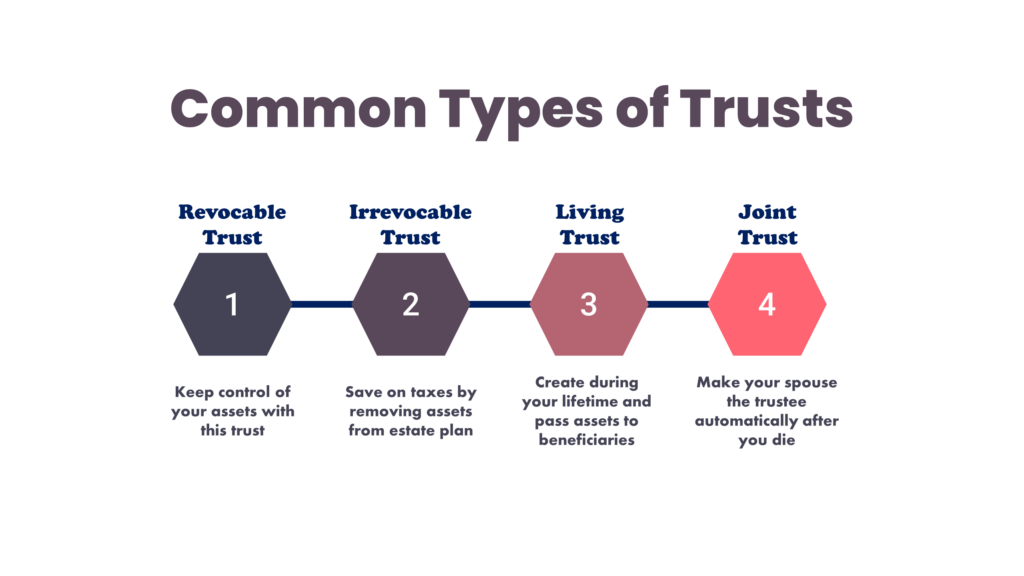

Additionally, developing a trust fund can supply a safe means to safeguard your assets for future generations. Trusts can assist you control exactly how your properties are distributed, lessen estate taxes, and shield your wealth from financial institutions. By executing these approaches and seeking professional guidance, you can secure your assets successfully and safeguard your economic future.

Long-Term Possession Security

Long-lasting asset defense includes carrying out measures to safeguard your properties from various hazards such as economic downturns, suits, or unexpected life events. One essential facet of long-term asset security is establishing a trust, which can use significant benefits in securing your possessions from creditors and lawful disputes.

Moreover, diversifying your financial investment portfolio is one more essential technique for long-term asset protection. By spreading your financial investments throughout different possession classes, industries, and geographical regions, look at here you can minimize the impact of market variations on your total riches. Furthermore, routinely examining and upgrading your estate strategy is important to ensure that your assets are secured according to your wishes in the long run. By taking an aggressive technique to long-lasting possession protection, you can safeguard your riches and supply monetary safety and security for yourself and future generations.

Final Thought

In conclusion, count on structures play a critical function in protecting assets and making sure monetary protection. Professional try this site advice in developing and taking care of trust fund structures is important for long-lasting possession defense.

Report this page