Trust Foundations: Ensuring Toughness and Reliability

Trust Foundations: Ensuring Toughness and Reliability

Blog Article

Guarding Your Properties: Trust Fund Foundation Competence at Your Fingertips

In today's intricate financial landscape, making certain the protection and development of your properties is critical. Trust fund structures offer as a cornerstone for guarding your riches and tradition, supplying a structured method to property protection.

Importance of Depend On Structures

Trust structures play a vital role in establishing reliability and promoting strong connections in numerous specialist setups. Trust foundations offer as the cornerstone for honest decision-making and clear interaction within companies.

Advantages of Professional Guidance

Structure on the foundation of count on expert connections, seeking expert advice uses vital advantages for people and companies alike. Expert guidance provides a wealth of understanding and experience that can assist browse intricate economic, lawful, or calculated difficulties easily. By leveraging the know-how of experts in different areas, individuals and companies can make educated choices that straighten with their objectives and goals.

One significant benefit of specialist advice is the capability to accessibility specialized understanding that may not be readily offered or else. Experts can provide understandings and perspectives that can bring about cutting-edge services and opportunities for growth. Additionally, working with specialists can assist reduce risks and unpredictabilities by supplying a clear roadmap for success.

Additionally, professional guidance can conserve time and resources by enhancing processes and staying clear of costly errors. trust foundations. Professionals can use individualized advice tailored to details needs, guaranteeing that every choice is educated and tactical. Generally, the advantages of expert assistance are multifaceted, making it a useful property in safeguarding and maximizing possessions for the long term

Ensuring Financial Security

In the realm of financial preparation, protecting a stable and flourishing future depend upon critical decision-making and sensible investment selections. Ensuring financial security entails a diverse approach that encompasses various facets of wide range management. One important component is producing a diversified investment profile tailored to individual threat tolerance and monetary objectives. By spreading investments throughout different possession classes, such as supplies, bonds, realty, and commodities, the risk of considerable monetary loss can be mitigated.

Additionally, keeping an emergency situation fund is necessary to protect versus unexpected expenses or income disturbances. Specialists suggest alloting three to six months' worth of living expenses in a fluid, quickly accessible account. This fund serves as a financial safeguard, giving satisfaction throughout unstable times.

On a regular basis examining and changing monetary plans in response to transforming scenarios is likewise critical. Life occasions, market fluctuations, and legislative adjustments can affect financial security, underscoring the relevance of continuous evaluation and adaptation in the pursuit of long-lasting financial protection - trust foundations. By carrying out these approaches attentively and continually, people can fortify their financial ground and job in the direction of an extra safe future

Protecting Your Assets Effectively

With a strong foundation in location for economic safety through diversification and reserve upkeep, the next crucial step is safeguarding your assets efficiently. Guarding assets entails shielding your riches from possible risks such as market volatility, financial declines, suits, and unpredicted costs. One reliable method is asset appropriation, which entails spreading your investments across various property classes to minimize risk. Diversifying your profile can assist alleviate losses in one location by balancing it with gains in one more.

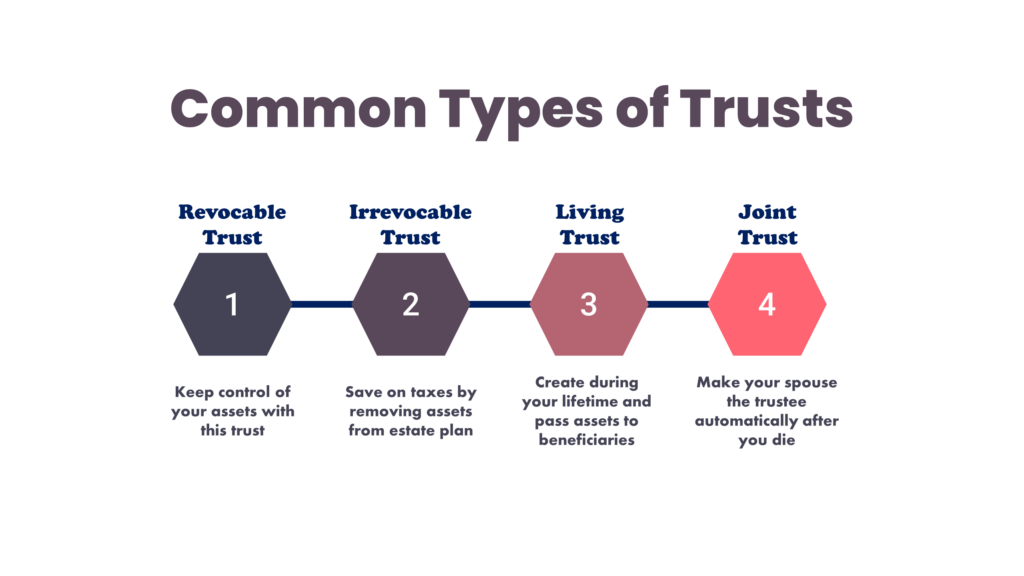

Additionally, establishing a trust fund can use a safe and secure method to shield look at this site your possessions for future generations. Trust funds can assist you regulate how your possessions are distributed, reduce estate tax obligations, and shield your riches from financial institutions. By executing these methods and seeking expert suggestions, you can safeguard your assets successfully and safeguard your economic future.

Long-Term Asset Security

To make certain the long-term protection of your wide range versus prospective threats and uncertainties with time, critical preparation for long-term asset security is necessary. Lasting property defense involves implementing measures to protect your assets from different dangers such as financial slumps, lawsuits, or unanticipated life events. One crucial facet of long-term possession defense is establishing a trust fund, which can supply substantial advantages in protecting your assets from financial institutions and legal conflicts. By moving ownership of properties to a count on, you can protect them from potential risks while still maintaining some degree of control over their administration and distribution.

Moreover, diversifying your investment profile is another essential method for long-lasting possession protection. By spreading your investments throughout various asset courses, markets, and geographical regions, you can lower the effect of market variations on your general wide range. Additionally, routinely assessing and updating your estate plan is important go to this site to make certain that your properties are safeguarded according to your dreams in the long run. By taking a positive technique to long-term possession protection, you can safeguard your riches and offer economic security for yourself and future visite site generations.

Conclusion

In verdict, trust foundations play a critical duty in safeguarding assets and making certain economic security. Specialist assistance in developing and managing depend on frameworks is crucial for long-term asset security.

Report this page